That said consider that if you want to practice tax law as an attorney youre likely in for at least 4 years of school since an LLM is almost always required for a decent law firm position. Tax accountants prepare tax returns for individuals or organizations and help clients ensure they correctly complete all relevant tax documents.

Here what youll need to start working as a tax attorney.

. Steps to become a LawyerAttorney in Canadian Provinces Territories. To obtain this background you can complete an undergraduate degree program in. A tax lawyer typically has a background in business or accounting.

For individuals tax attorneys use trusts gifts and various tax planning structures to reduce the. Answer 1 of 4. It seems to me.

How to Become a Tax Attorney. A tax attorney is a licensed attorney who specializes in tax law. Theres not a perceived glamour to being a cpa compared to an.

Take the full ride tier 2 isnt a bad place to be. Apply for a summer internship at a tax law firm after your first year of law school to gain valuable experience and increase your chances of finding employment after. Training Preparers is All We Do.

The Tax Attorney occasionally directed in several aspects of the. In any event the issues are interesting and of vital importance to your client. As a first year lawcommerce student in Queensland the idea of becoming a tax lawyer seems quite appealing.

Additionally Tax Attorney requires admittance to a state bar. Earn a Bachelors Degree. The best electives for aspiring tax attorneys include general business taxation financial.

Follow the step by step process or choose what situation that best describes you. Honestly tax lawyer is an entirely different path from a cpa. I can say that tax law is truly an incredibly fun and intellectually engaging field.

Press question mark to learn the. We Dont Sell Tax Software or Tax Franchises. A tax lawyers work can range from interpreting newly passed legislation to applying long-standing law.

A cpa at the big 4 will start out in the mid-50k range and maybe be. If your business faces legal tax issues you need to hire a tax attorney because they have a deeper understanding of the legalities in the US. Ad Clear Up-to-Date Program Teaches All You Need to Know.

Training Preparers is All We Do. We Dont Sell Tax Software or Tax Franchises. What would a tax accountant do in their respective division and what would a tax lawyer in house counsel i suppose do.

In fact the accounting field. The ceiling for cpa is much lower and compensation reflects that. Get B4 experience in consultingtax and when you want aim for regional law firms.

Students will receive the following. Just stay and work your way up if you want to work at the B4. 5 hours of recognized credit with the University of.

Get Certified in 8 Weeks. That being said the majority of the high level planning work happens with. The first thing youll want to do is go to school and earn a bachelors degree.

Bachelors degree Youre only requirement is to have finished a 4-year program from a universityhowever it. Get A Bachelors Degree. The tax attorney salary is normally paid annually with the median hourly payments of the United States which is 115800 by the Bureau of Labor.

The Masters of Laws LLM Program The Masters of. From there your tax lawyer can make a suggestion. A tax lawyer can look at your expenses compared to your income and evaluate what your quarterly expenses should be.

Get Your Undergraduate Pre-Law. Press J to jump to the feed. Hire a tax attorney if.

Once tax attorneys have become EAs they are granted unlimited practice rights when representing clients before the IRS. Get Certified in 8 Weeks. As a tax attorney I was about to say pretty much the same things as Quora User who did a good job with a simplified answer to a question about a very complex area.

This includes four years of pre-law and a minimum of three years of law school. Large law firms with a varied tax practice are a common starting point for law school graduates interested in tax law. As for what your major should be consider taking business or accounting.

Typically reports to a manager or head of a unitdepartment. After completing law school. While many law schools offer specialized certifications in this field or even a specialized masters degree.

Ad Clear Up-to-Date Program Teaches All You Need to Know. Some tax lawyers also study for an additional year to. Tax attorneys spend their time trying to ease the financial burdens associated with both.

To become a tax lawyer you need a bachelors degree in finance accounting or taxation followed by a Juris Doctor JD degree. Tax Attorney Average Salary. Answer 1 of 6.

I Just Graduated Art School What Do I Do Invoice Template Invoice Layout Contract Template

Bankruptcy To Business Owner By The Age Of 30 Texas Art And Soul Create A Paint Party Business Online Business Owner Business Money Problems

I M A Cryptocurrency Tax Attorney Helping Traders Stay Out Of The Irs S Crosshairs Ama R Cryptocurrency

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

Highest Paid Lawyers For 2022 The Best Tax Attorney

Irs Tax Audits How Likely How To Handle Them David Klasing

Tax Accountant Career Overview

How To Work Part Time In Tax Prep And Why You Would Want To Intuit Official Blog

Is A Tax Preparer Liable For Mistakes Tax Preparer Penalties

Why You Need A Small Business Tax Attorney Silver Tax Group

What Math You Have To Take To Become A Lawyer

I M A Cryptocurrency Tax Attorney Helping Traders Stay Out Of The Irs S Crosshairs Ama R Cryptocurrency

Top Rated Tax Resolution Firm Tax Help Polston Tax

10 Things To Say Instead Of Stop Crying Coolguides Stop Crying Crying When Someone

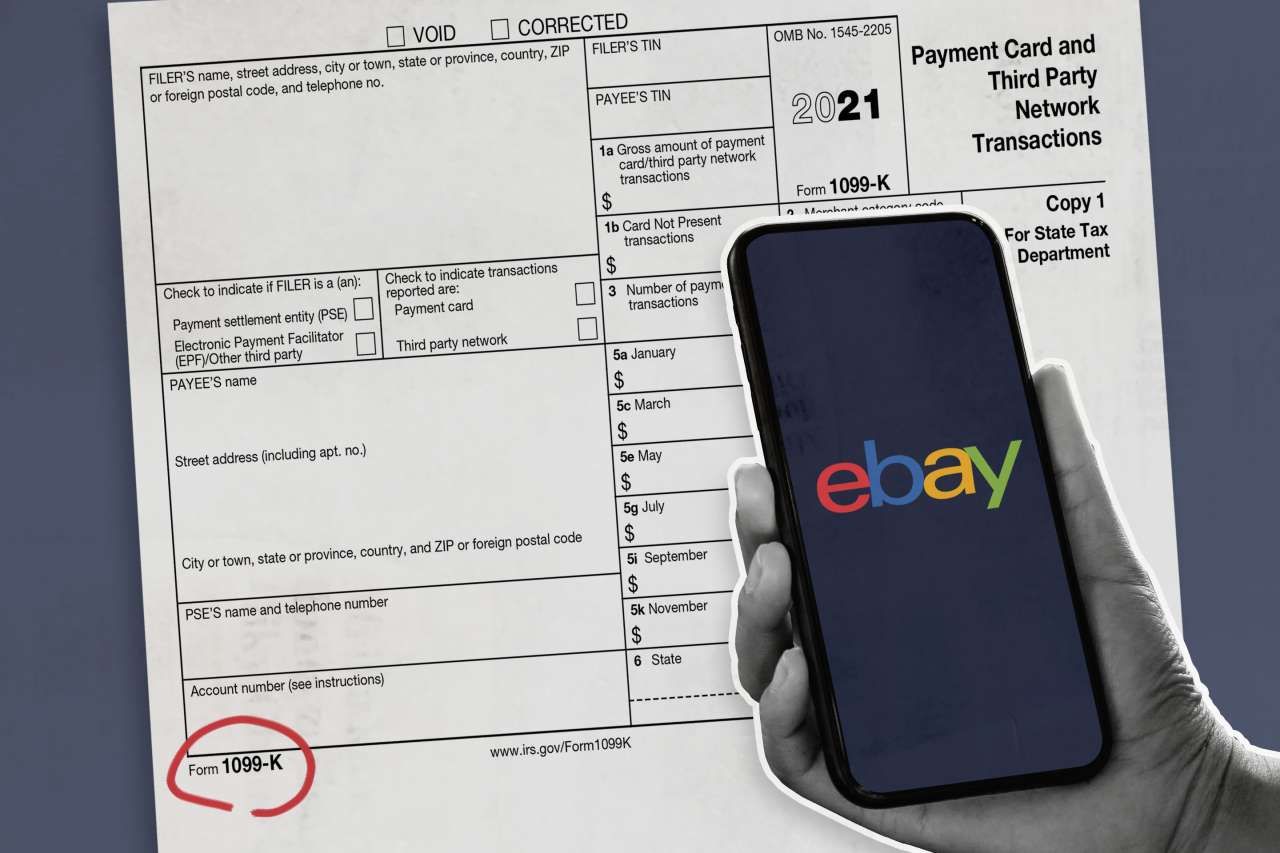

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

Irs Tax Audits How Likely How To Handle Them David Klasing